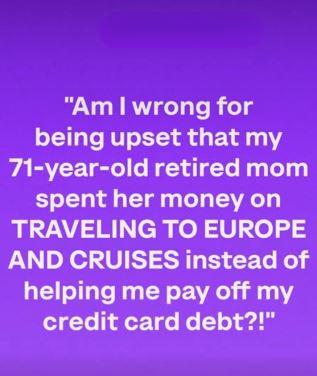

The Generational Divide: Should a Retired Parent’s Money Be Their Own, or a Lifeline for Their Child’s Debt?

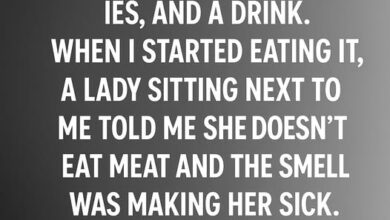

In a world of rising costs, a 71-year-old retired mother’s choice to spend her savings on European travel and cruises instead of helping her adult child with credit card debt has sparked debate. The child feels betrayed, believing family should be a financial safety net, as their debt causes stress and limits their future. Meanwhile, the mother, after years of hard work and sacrifice, sees retirement as her time to enjoy life, viewing her spending as a reward, not neglect. She may believe her child should learn financial independence. Both perspectives are valid, but the conflict stems from unspoken expectations. Open communication is key: the child should focus on budgeting or seeking financial advice, while the mother can offer emotional support without sacrificing her dreams. Love doesn’t always mean financial aid—sometimes it’s fostering independence